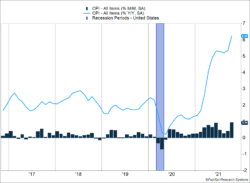

An inflation surprise created a challenge for investors. The Consumer Price Index rose 0.9% last month. The monthly increase was the largest reached in 2021, and the yearly increase of 6.2% was the largest since 1990, when the Gulf War contributed to a surge in oil prices (Figure 1).

Key Points for the Week

- Inflation surged in the U.S. in October. The Consumer Price Index rose 0.9% and is 6.2% higher over the last 12 months.

- With 92% of S&P 500 companies reporting, earnings skyrocketed approximately 39% last quarter.

- The percentage of the labor force voluntarily quitting their jobs reached a record 3%.

Corporate earnings results provided a salve for those worried about inflation. Earnings skyrocketed 39% last quarter as companies bounced back from weaker sales due to the pandemic. A higher percentage of companies beat expectations and beat them by wider margins, contributing to the strong results.

The inflation data proved too much for markets last week. The S&P 500 fell 0.8%. The MSCI ACWI was basically unchanged as international economies aren’t feeling inflation pressures as strongly as the U.S. The Bloomberg U.S. Aggregate Bond Index sank 0.8% as higher inflation provides a direct hit to the real return of bonds.

Figure 1

Inflation Becoming Entrenched

Inflationary pressures are becoming more ingrained in the economy. Last month’s 0.9% increase in the CPI raised the annual inflation rate to 6.2% (Figure 1). The large monthly increase and relatively low inflation in the same month last year pushed the annual number higher and ended a period wherein the annual inflation rate moderated. Supply chain woes continued as ships were unable to unload and many unfilled jobs are providing challenges for companies.

Much of the inflation came from the volatile food and energy segments. Energy prices are up 30% in the last year and food prices have jumped 5.3%. Core inflation, which excludes food and energy, increased 0.6%. Core prices are up less than overall inflation, but prices are still rising more rapidly than the Federal Reserve desires. The shortage of semiconductor chips is forcing auto manufacturers to raise prices. New vehicle prices jumped 1.4% last month and used vehicle prices bounced 2.5% higher. Produce prices also remained strong, rising 0.6% last month.

Many wonder why inflation is picking up so quickly after being so low for so long. The quickest answer is the economy is trying to adjust to the items demanded from the pre-COVID economy. During the pandemic, goods have been easier to use than services. Shifts toward consumers buying more goods has pressured the capacity of the global supply chain, which suddenly feels elongated and vulnerable to shutdowns. The steady diet of direct payments to citizens likely contributed to demand for more goods just as supply was contracting.

Companies are concerned about inflation. The term “inflation” is typically mentioned in about 25% of company earnings reports. For the third quarter earnings-to-date, 57% of companies cited the term “inflation” in their reports, which is the highest percentage since 2010. The industries that had the highest concentration of inflation mentions were materials (89%), consumer staples (88%), and energy (86%). However, talk of inflation in these reports is mostly forward-looking. Profit margins are at a near-record high of 12.9%, which indicates either companies are passing the higher costs on to others or they haven’t experienced the rising costs yet.

Companies are caught in a difficult situation of trying to ramp up production without being able to find workers. Job openings remain above 10 million, and an estimated 3% of the U.S. workforce quit in September. In the leisure and hospitality industry, which includes restaurants, the quit rate was 6.4%. When workers are in short supply, pay increases are one way to recruit the necessary staff even as prices often increase to reflect the higher costs.

The high rates of inflation are beginning to pose a challenge to the Federal Reserve. When the Fed is targeting core inflation of 2% and inflation is above 4%, the Fed is pressured to taper and eventually raise rates. Market expectations for a hike by the middle of next year increased to 71% from 53% one week earlier.

If the Fed moves up its first hike from the end of next year to the middle, expect a “hike across the bow” where the Fed raises rates one time and pauses to gauge the effects. A shot across the bow is a naval term meaning warning shot. A “hike across the bow” would let investors know the Fed remains serious and diligent as the economy continues to work through a unique market period. Fed communication has become a bigger risk as any Fed action must be well communicated to not unnerve investors.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.bls.gov/news.release/jolts.nr0.htm

https://www.bls.gov/news.release/pdf/cpi.pdf

Compliance Case #01186106